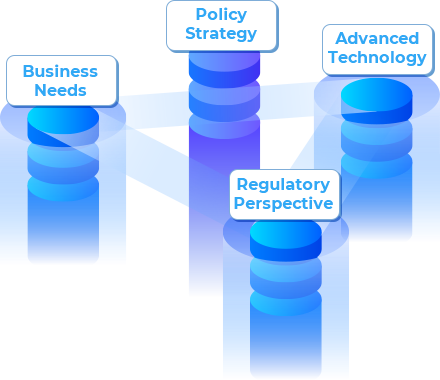

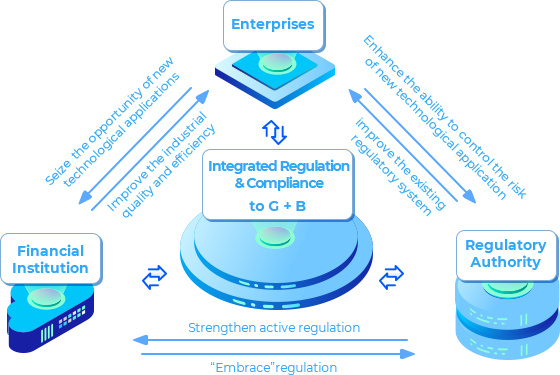

REGTEK is a company dedicated to providing regulatory technology. Adhering to the concept of “integrating regulation and compliance”, with the goal of “comprehensively utilising advanced information technology to enhance financial innovation service capabilities and risk prevention capabilities”, our company provides internationally advanced regulatory technology solutions for policy makers, regulators, financial institutions, and industrial institutions, helping all parties from building consensus, deepening collaboration to forming synergy, and effectively implement the financial stability and development policy strategies, improve financial innovation service capacity and risk prevention capabilities.

A team of experts on regulatory policy and industry standard design.

A team of experts on business innovation and technology integration.

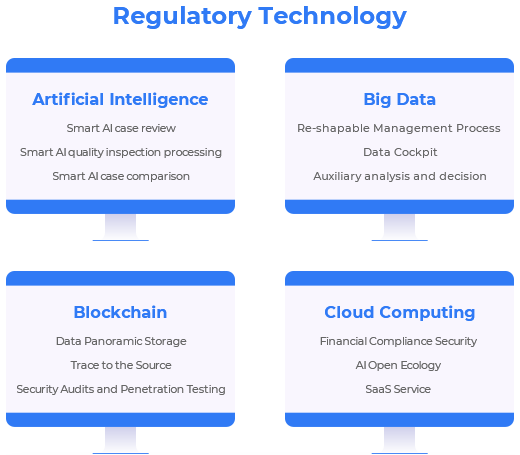

Our team of experts specialise in the comprehensive application of Fintech design tools including artificial intelligence, blockchain, Internet of Things and privacy-enhanced computing.

- REGTEK (BEIJING) TECHNOLOGIES Ranks Amongst the Top 30 Zhongguancun Financial Technology Companies in 20222022-12-22

- 2022 Annual LEI Application Promotion Seminar Was Successfully Held2022-12-01

- The first LEI-embedded Financial Green Digital Base that supports cross-border applications of green finance and ESG2022-08-23

- Empowering the Digital Transformation of Green Finance – REGTEK (Beijing) Technologies Released the Financial Green Digital Base(China Finance)2022-07-29

- Representatives of REGTEK (Beijing) Technologies Attended the Regular Meeting of the GLEIF Vendor Relationship Group and Shared the Applications of LEI under the Concept of Regulatory Technology2022-02-16

- REGTEK (Beijing) Technologies Became a Member of the GLEIF Vendor Relationship Group2022-01-30

- Regulatory Technology Helps Post-Loan Management(China Banking And Insurance News)2022-05-18

- High-quality Development of Green Finance(Zhongguancun Fintech Industry Development Alliance)2022-03-27

- Making Friends with “Standards” - Interpretation of the 14th Five Year Plan for Financial Standardization(China Banking And Insurance News)2022-02-16

- Regulatory Technology in Digital Economy Era(China Finance)2022-02-11

Design and marketing of Regtech products and platforms.

Research and consulting services on regulatory and financial services industry policies.

Regulatory & financial industry standards formulation and implementation services.

Research and consulting services on the risk of comprehensive application of Fintech.

-

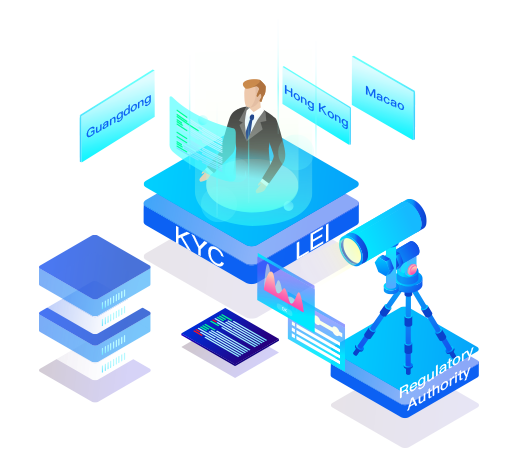

Guangdong-Hong Kong-Macao Greater Bay Area KYC platform based on the Legal Entity Identifier (LEI)

Guangdong-Hong Kong-Macao Greater Bay Area KYC platform based on the Legal Entity Identifier (LEI)The LEI-based Guangdong-Hong Kong-Macao Greater Bay Area KYC platform applies LEI codes and blockchain technologies to the KYC scenarios for enterprises opening business accounts with commercial banks. On the one hand, this practice provides convenience for legal entities in Greater Bay Area to open business accounts with banks in Guangdong, Hong Kong and Macao, whereby reducing waiting time, optimising the audit process, enhancing the level of customer information management for commercial banks in Greater Bay Area, and reducing operational risks and compliance costs.

-

Middleware of Regtech

Middleware of RegtechRegtech Middleware implants the logic of Regtech into the middleware layer. It adopts standardised interfaces and protocols, improves the application layer’s ability to protect data privacy and to implement various latest regulatory policies from the technical level, and eliminates management and operational risks. This enables relevant institutions to achieve “not wanting” to violate, “dare not” to violate the rules and at the same time also “incapable” of violating the rules.

-

Post-loan Regulatory Technology Service Platform

Post-loan Regulatory Technology Service PlatformThe post-loan regulatory technology service platform is a new-generation service platform that uses new technological means to provide coordinated cooperation between regulators and businesses, jointly resolve disputes and prevent risks. On the one hand, the platform strengthens the protection of the legitimate rights and interests of consumers, and on the other hand, it strengthens the screening of malicious acts affecting the financial market, and also provides efficient off-site inspection methods for regulators, which will effectively improve the digitalised post-loan management level and regulatory compliance level.

-

Financial Green Digital Base

Financial Green Digital BaseThe “Financial Green Digital Base” is a set of integrated solutions designed and developed for regulators, financial institutions and industrial practitioners to implement the national strategy of “Carbon Neutrality & Carbon Peaking (Dual Carbon)” and digital economy development. The system applies the concept of regulatory technology, injects policy requirements, industry standards and economic rules into the digital transformation of financial business, and uses a Lego-style product combination to build a comprehensive system to integrate policy information, financial information, Dual Carbon information, and business information. It supports green development and digital transformation in a comprehensive, efficient and flexible manner.